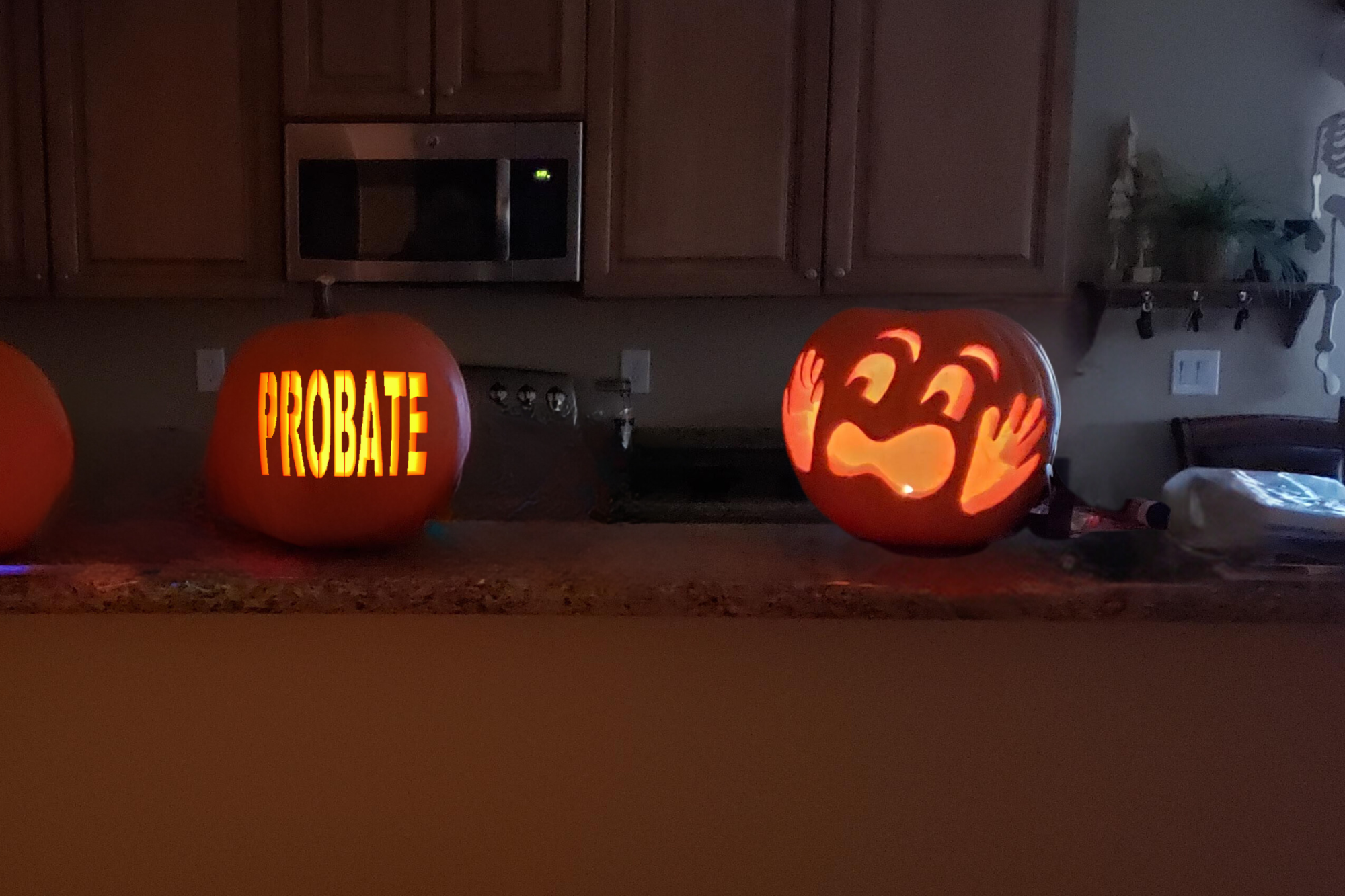

Keep Your Trust Current to Avoid Probate

By Libby Banks, The Law Office of Libby Banks, PLLC Most of our clients who have created a revocable living trust with us do so to avoid probate. Probate is the court proceeding filed in order to appoint an executor – called a personal representative in Arizona – to be able to access a deceased person’s bank accounts and assets and settle their estate. It’s expensive, time-consuming for your heirs, and a public proceeding – anyone can go look at what’s been filed in the probate court. Not only does it expose your affairs to anyone who cares to look, it allows...

Continue reading